quitclaim deed colorado taxes

And providing copies of those. Legal Requirements for a Quitclaim Deed in Michigan.

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

It offers little protection to the person receiving the interest so it is most often used between family members who have already established trust such as gifting a house to a close relative.

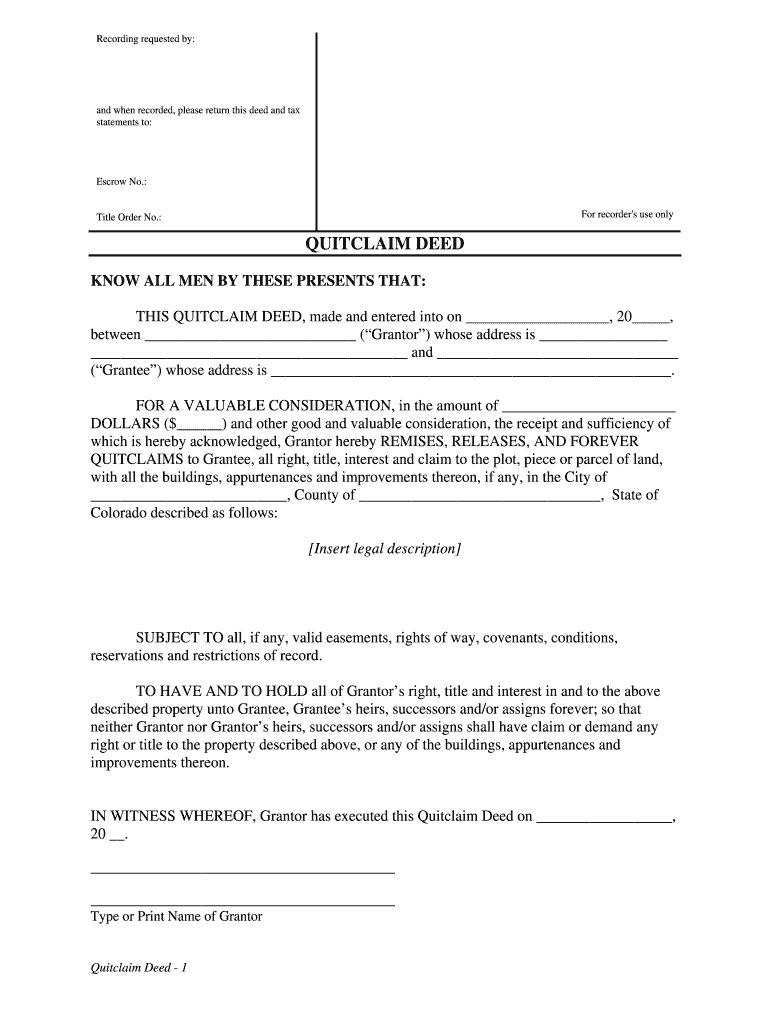

. Using a quitclaim deed is a common and simple way to transfer property. A quitclaim deed is often used to transfer the ownership interest of property from a person to trust. The quitclaim deed also called a non-warranty deed offers the grantee the least amount of protection.

Gift Tax Implications of Putting Children on a Quitclaim Deed. A quitclaim deed can be used to clear up minor issues on the existing chain of title such as the misspelling of a name. The following are the different types of power of attorney.

The main focus of the Recording Department is first and foremost the maintenance and integrity of the Larimer County Public Land Records which date back to 1862. Durable power of attorney a durable power of attorney goes into effect if you become incapacitated for example in a coma and cant make decisions yourself. In states with documentary transfer taxes based on the amount of consideration including Florida and California specifying that the property was a gift can save transfer taxes.

A lady bird deed also called a ladybird deed or an enhanced life estate deed is a special form of life estate deed that gives the owner continued control over the property until his or her deathOnce the owner dies the property is transferred automatically to new owners without the need for probate. Make yours for free and save print download. You may want to check this before clicking the Finalize.

With a quitclaim deed you can name your spouse as the propertys joint owner. A quitclaim deed can be a relatively easy and quick way to add someone else. This type of deed conveys whatever interest the grantor currently has in the propertyif any.

A Business Contract is a legal document for two parties to set the terms of a business relationship. General financial power of attorney allows someone to make financial and business decisions on your behalf. The easiest way to grant your spouse title to your home is via a quitclaim deed Californians generally use an interspousal grant deed.

The excluded amount is taken off the taxpayers total allowable lifetime exclusion. Transfer property to or from a revocable living trust. A warranty deed would be used during the purchase of.

Legally Transfer Property with a Quitclaim Deed. Because quitclaim deeds make no warranty about the quality of the grantors title they are best for low-risk transactions between. It conveys whatever interest you have in a piece of property without making any promises about the type of interest youre conveying.

The quitclaim deed must include the propertys description including its boundary lines. Use a QuitClaim Deed to. If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the quitclaim is conveyed by a couple filing jointly are excludable from tax.

Capital Contribution If property is being transferred to a business the consideration received in exchange for the interest is often capital in the company. Our duties include the recording and imaging of documents for the permanent public record. A Quitclaim Deed is a document stating that a person is giving up their legal interest in a real property such as land or a house.

Providing a grantorgrantee index for search and retrieval of recorded documents. If your goal is to add an owner to the title to the property you should only list the person being added to the property on the New Owner Information screen. Duplicate New Owner Entry It looks like you entered the same person on both the Current Owner Information screen and the New Owner Information screen.

Some of the. The County Register of Deeds Office will only allow you to file record the quitclaim when the taxes are paid unless the transfer is exempted from the transfer tax. The transfer taxes will include the taxes imposed by the county the property is located as well as the state.

Only accept a quitclaim deed from grantors you know and trust.

Growing Your Notary Business With Craigslist Nna Notary Signing Agent Notary Notary Public

Moving Checklist Realestate Realestateagent Realestatebroker Realtor Listing Realestatelisting Listingpresentation R Moving Checklist Checklist Moving

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quit Claim Deed Fill Online Printable Fillable Blank Pdffiller

Free Quit Claim Deed Form Printable Pdf Template

Real Estate Transfer Taxes Deeds Com

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Power Of Attorney Form Room Rental Agreement

Quitclaim Deed Ez Estate Planner

Is A Quitclaim Deed Subject To Tax Deeds Com

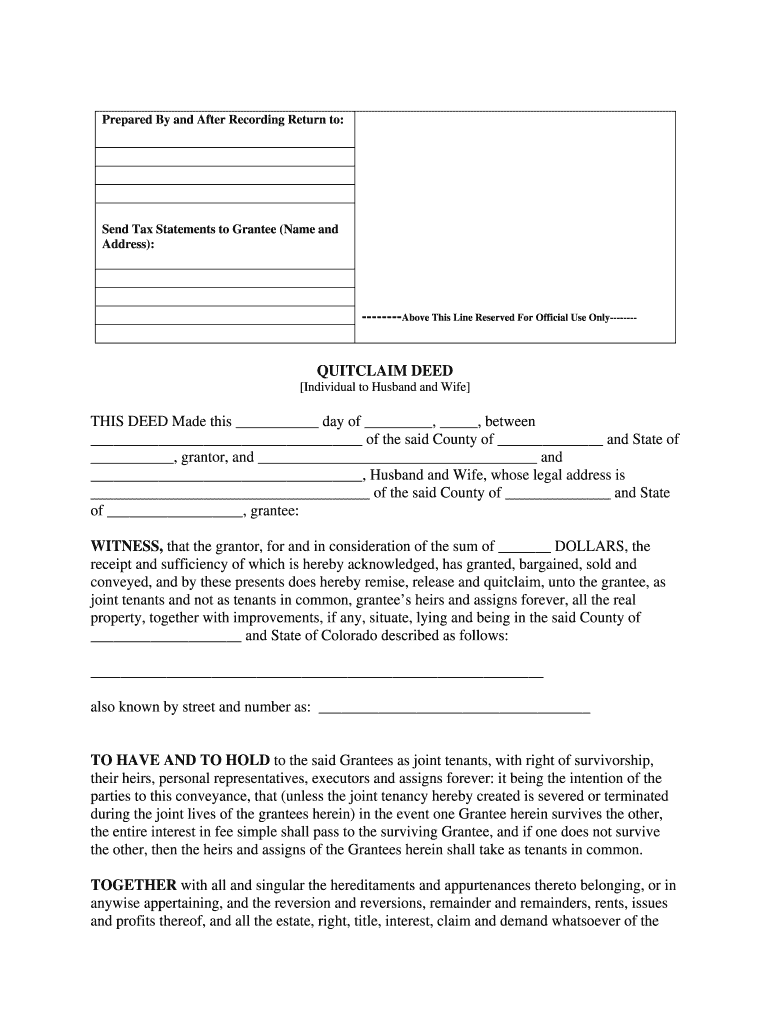

Colorado Quit Claim Deed Joint Tenancy With Right Of Survivorship Fill Online Printable Fillable Blank Pdffiller

Should I Sign A Quitclaim Deed During Or After Divorce

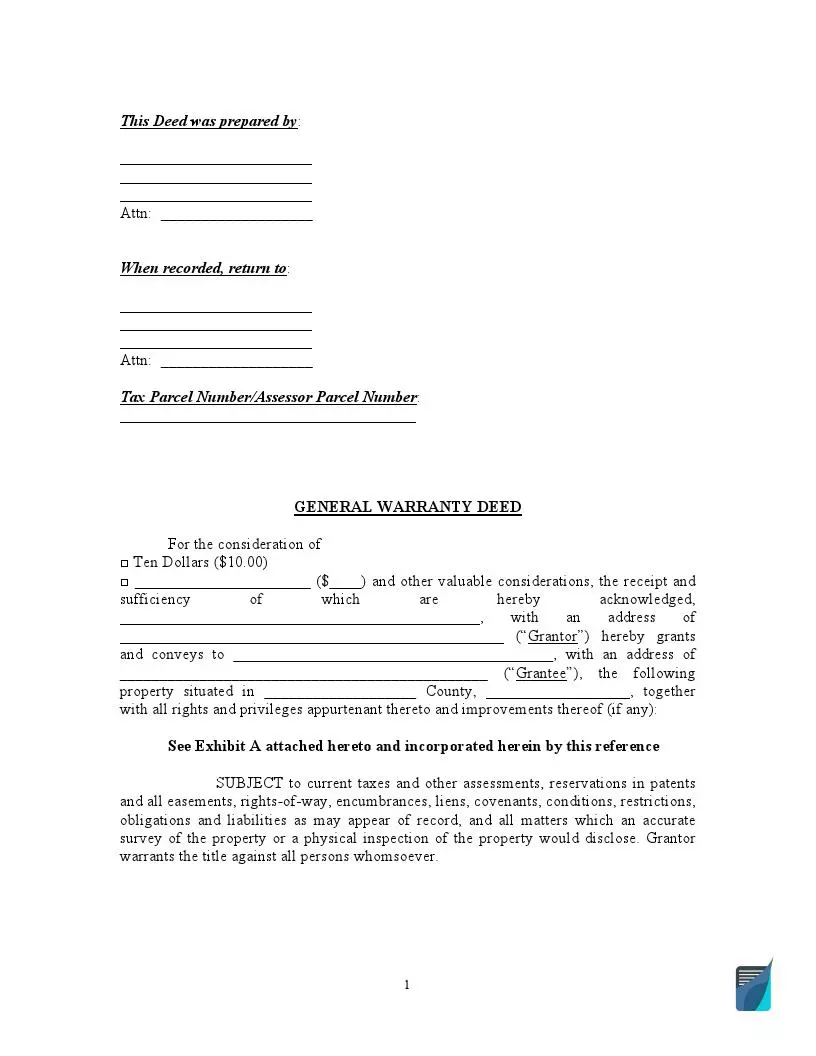

Free Bargain And Sale Deed Free To Print Save Download

New Jersey Quitclaim Deed Form Download Printable Pdf Templateroller

Are Quitclaim Deeds As Easy As They Sound Or Are They A Tax Trap Accountant Cpa Atlanta Ga Eliseo Cpa Llc

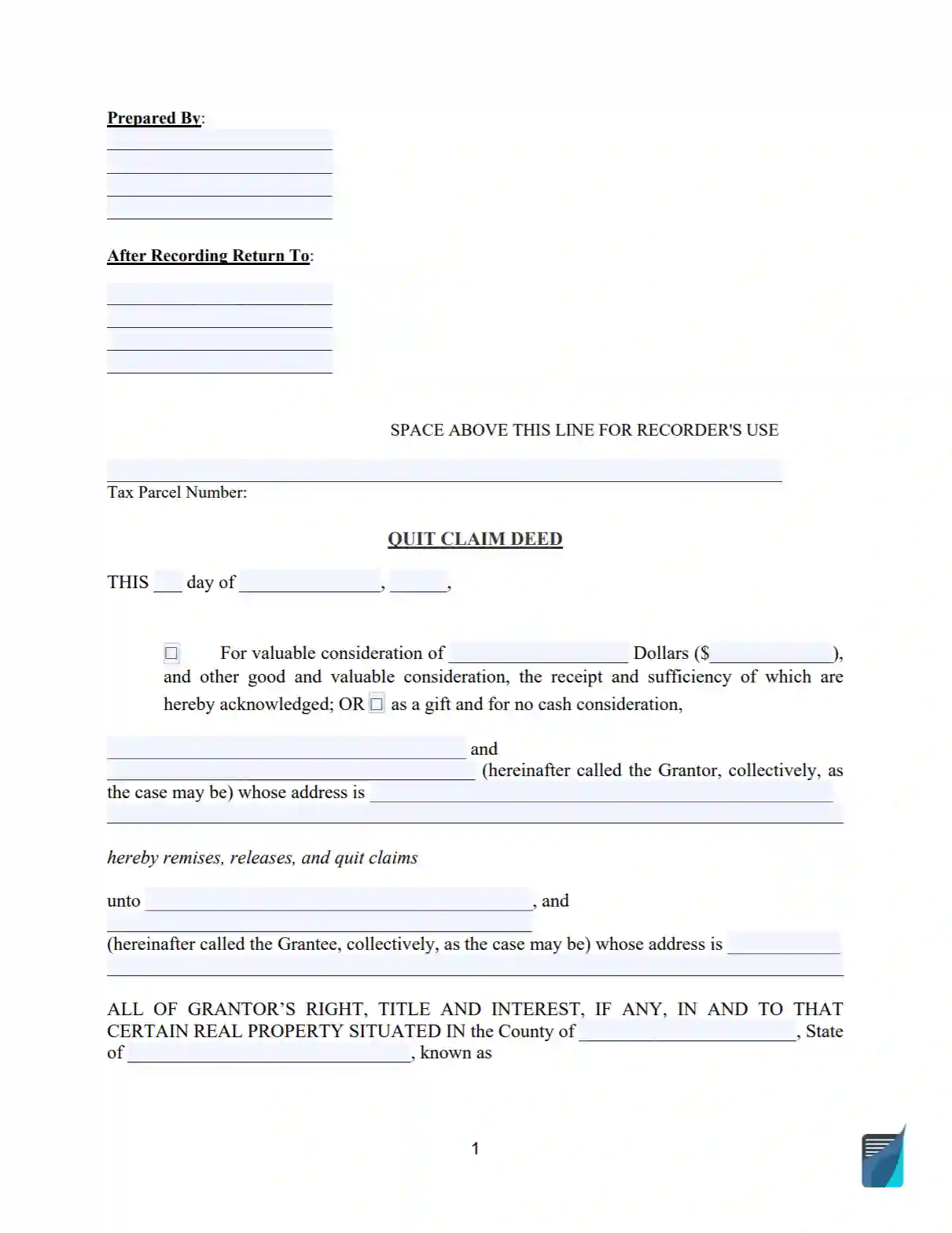

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Should I Sign A Quitclaim Deed During Or After Divorce

Free General Warranty Deed Form Fillable Pdf Template

Quitclaim Deed What Are The Tax Implications Money

Colorado Quit Claim Deed Fill Online Printable Fillable Blank Pdffiller